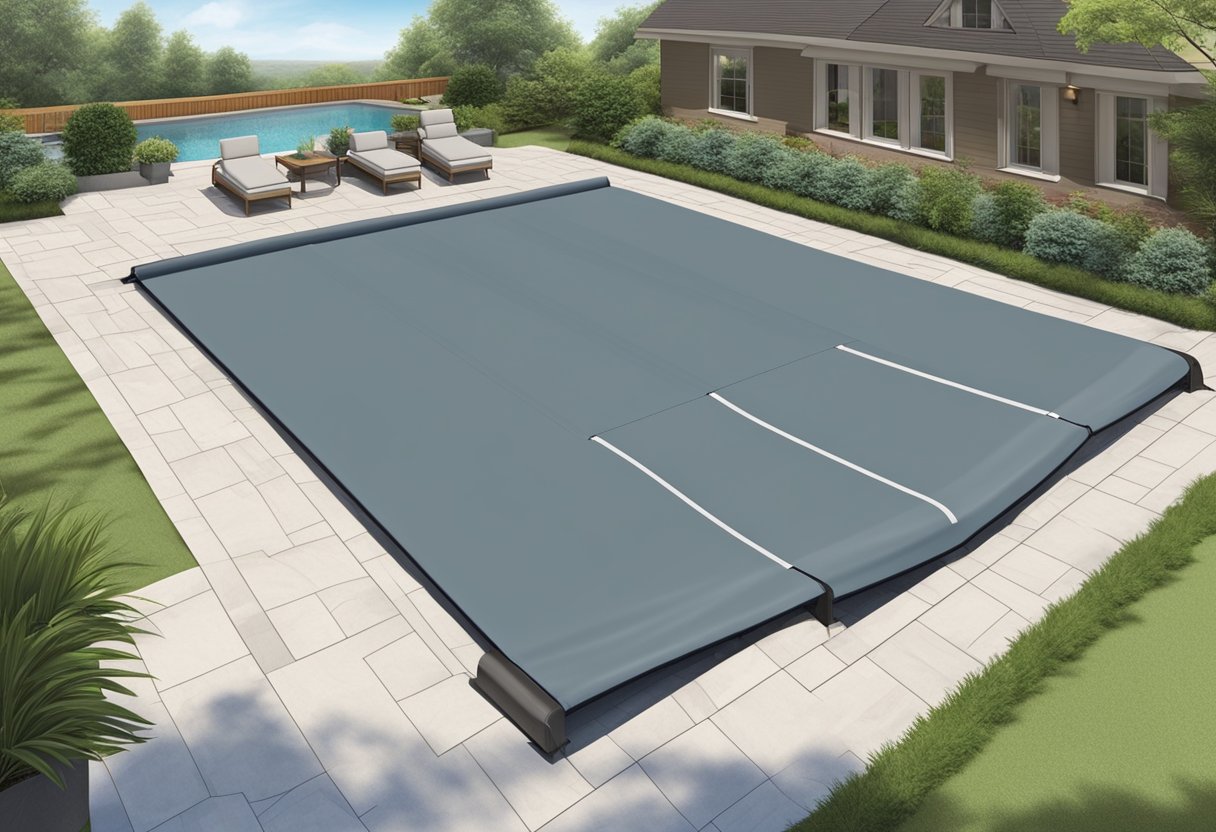

Investing in an automatic pool cover is a decision that weighs convenience against cost. The price of these covers varies, generally influenced by the pool’s size and the specific type of automatic cover selected.

In South Africa, for example, the range for an automatic pool cover can be from R50, 000 to R150, 000. Factors that affect the price include the dimensions of the pool, the material of the cover such as vinyl, and additional features like UV resistance or integrated solar panels.

The upfront cost of an automatic pool cover may be significant when compared to other types of covers like winter or solar covers. Nevertheless, the long-term benefits of reduced cleaning, lower heating costs, and enhanced safety can offset the initial investment.

By reducing water evaporation and keeping the pool clean from debris, automatic covers can also help to maintain a balance in chemical levels, leading to potential savings in maintenance expenses.

With a spectrum of options available, the market offers a range of solutions to fit various needs and budgets. From the deluxe, top-of-the-line models that promise style and durability to more basic, yet functional designs, customers are advised to consider the longevity and warranty offered by the manufacturer.

Such considerations ensure the pool cover not only meets immediate practical needs but also stands as a sound long-term investment for any pool owner.

Cost Factors and Considerations

When considering the purchase of an automatic pool cover, one should be aware of several cost factors. These include the materials used, the size and shape of the pool, and the brand’s reputation, all of which can have a significant impact on the final price.

Material and Quality

The choice of material greatly affects both the durability and cost of an automatic pool cover. Vinyl is a popular choice due to its longevity, but it can prove expensive.

High-quality materials that offer UV resistance and added safety features could also drive up the cost. Moreover, designer pool covers that utilise premium materials or bespoke design elements can come with a higher price tag.

Size and Shape

The dimensions and contours of a pool determine how much material is necessary and the complexity of the installation.

A simple rectangular cover may fall on the lower end of the cost spectrum, whereas a cover for a non-standard shape or a larger pool requires more material and labour, increasing the cost.

| Pool Size | Estimated Cost Range (USD) |

|---|---|

| Small | 2, 000 – 10, 000 |

| Medium | 10, 000 – 15, 000 |

| Large | 15, 000 – 25, 000 |

Brand Reputation

Brands with a reputation for quality often command higher prices. A renowned brand can guarantee durability and after-sales service but may add to the initial investment.

The brand’s reputation can also reflect in the design options available, with some brands offering more elegant or designer pool covers at a premium.

Installation and Maintenance

When opting for an automatic pool cover, homeowners should prepare for the processes of installation and ongoing maintenance, which both influence the overall value and functionality of the pool cover. These factors play crucial roles in the long-term performance and protection that the cover provides.

Installation Process

The installation of an automatic pool cover is a precise task that typically requires professional expertise, particularly when dealing with electrical components and custom fitting to the pool’s dimensions.

Prices for installation in South Africa can vary widely, influenced by the complexity of the pool’s design and location. For instance:

Pool cover pretoria and Johannesburg: Costs can range from R1, 000 to R3, 000, with the high end reflecting more intricate installations.

- Other factors: The pool size and the type of cover chosen directly affect the installation cost.

An installation in Pretoria or Johannesburg typically requires a skilled contractor to ensure that the pool cover is fitted accurately and operates seamlessly with the existing pool structure.

for more info: https://designerspoolcovers.com/